Living with Higher Cocoa Prices

Posted: 16 Apr 2024

Living with Higher Chocolate Prices

The beginning of 2024 has seen further, relentless increases in the cocoa price, from £3500/MT on 1st January to around £5600/MT at the end of February. It’s becoming increasingly obvious that higher cocoa prices are here to stay – at least for the time being – and in this article, we look at different ideas on how to adapt and manage your business in a world of higher chocolate prices.

Feel free to skip forward to whatever interests you most:

- The cocoa price – breakout territory

- How is this translating to chocolate prices?

- And what does it mean for the price of your products?

- Ideas to help your business adapt and thrive, long term

1. The Cocoa Price - Unchartered Territory

The chart below shows a 35 year perspective of the cocoa market. You can see that the price of cocoa traded broadly within the range £600-£1300 per MT until 2008 and then between £1500-£2300 until the end of 2022.

From January 2023 onwards, it seems to have broken decisively out of its previous trading range and since then it has been one way traffic all the way up to around £5600/MT at the end of last week!

These are some of the key long-term drivers of this sharp increase in the price of cocoa.

- Several years of small crop shortages, with talk that this year the shortage could be as high as 1-1.5m tonnes, which would be 20-30% of the world’s annual consumption. This is having a dramatic effect on world stockpiles of cocoa.

- The implications of the new EU deforestation regulations (EUDR), whose likely full impact is still unknown. Ivory Coast is said to have lost around 85% of its forest since 1960 and this is what the EUDR is designed to address, alongside other issues such as child labour.

- The mounting challenges facing the cocoa farming industry by deforestation, El Nino effects, political instability, climate change, illegal mining and disease.

Of course, market speculators are also very active right now and this is creating significant additional short-term pressure on the cocoa price.

As it stands, the only thing that seems certain is that there will be considerable volatility in the short term. The cocoa price may well keep going up for a while yet and if and when it does come down, it is unclear how far down it will actually come and over what period of time. Much will depend on how good the main harvest is in the new season starting October 2024.

Over the longer term, higher prices should incentivise farmers to plant more cocoa, farm more sustainably and use better techniques to increase yields, but that will likely take at least 3-5 years to materially impact the size of the crop or bring prices down.

2. How is This Translating to Chocolate Prices?

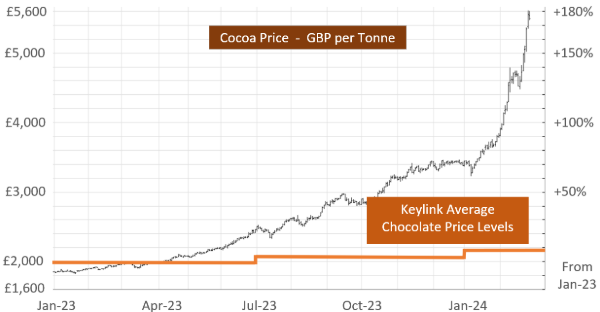

The chart below shows the cocoa price since 1st January 2023 alongside the price level of a basket of our most popular dark and milk chocolates.

The key thing to note is that price levels of chocolate at Keylink (as with most distributors) are lagging well behind the rise in cocoa prices. So it is inevitable that they will go up significantly in the coming months.

The main reason for this lag is that most businesses, chocolate makers in particular, will enter into forward contracts for 6-12 months and so the prices you are seeing today are really from early to mid 2023. But eventually all these contracts will get used up and prices will have to increase to reflect the current cocoa price.

It is also worth bearing in mind that dark chocolates (average 60% cocoa content) will go up by more than milk/white chocolates (average cocoa content 28-35%), based simply on the cocoa content of the product.

3. And How Will it Translate to the Price of Your Products?

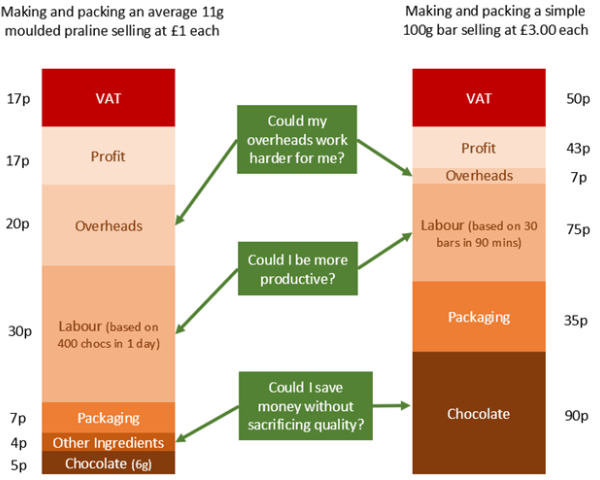

The diagram below shows the hypothetical cost breakdown of making a praline and a 100g bar for a typical artisan chocolatier with just table-top melters or wheel machines and a limited number of moulds.

Your costs may well be quite different to those below, but the breakdown is just intended as an illustration and the same principle will apply.

Just as an illustration, let’s imagine that the price of chocolate doubles in the short term, while all other costs remain the same.

In the case of the praline, your chocolate cost would go up from 5p to 10p, which means your total cost would go up from 83p to 88p, a 6% increase. Passing this on should be acceptable to your customers.

In the case of the 100g bar, your chocolate cost would go up from 90p to 180p, which means your total cost would go up from £2.50 to £3.40, a 36% increase. This is going to be much, much tougher to pass on to your customers!

In the short term and given the circumstances, it would be natural to shop around for the best possible chocolate price – if you are making bars, it may even be essential. However take a moment to consider why your customers buy your products? If it is for the taste and quality, then is it wise to sacrifice that quality or consistency by continuously switching to the cheapest available chocolate at that moment?

Eventually price levels should stabilise again, allowing you to go back to your preferred chocolate, so why not just stick with it rather than deal with the burden of changing recipes and labels? Let’s look instead at other ways to make the numbers work, rather than compromising on the quality of your ingredients.

4. Ideas to Help Your Business Adapt and Thrive

The most obvious thing to do is to increase your prices, so if you need to do that in the short term, then you should do it because every business needs to be profitable to survive.

But once you hit the limit of what your customers will accept, then what? Well the answer is to look at other parts of your cost structure to see where you can make savings and reduce the cost per unit wherever possible.

Could my Overheads Work Harder for Me?

The size of your premises is fixed, as are most of your fixed costs, such as rent, rates and utilities. So the best way to reduce the cost per chocolate of your overheads is to sell more product, thereby spreading the fixed cost over a larger number of units sold.

You could start selling other complementary products alongside your chocolates – in other words, diversify so you are using less chocolate across your overall business. Hotel Chocolat sell a salted caramel vodka (and a cacao pulp gin!). Some chocolate shops sell a chocolate-scented candle, or have diversified into cakes/coffee/ice cream, etc. As an extension to that idea – and it’s one we suggested during the pandemic – some might use one or two of their chocolate products as part of a hamper containing other non-chocolate goods.

You could also just make more chocolates – if you have the capacity, then could there be more opportunities to sell more products and grow your business?

You can also position yourself as more premium than you did before which would help justify higher prices. Promote the idea that chocolate is an ‘affordable luxury’ compared to other things like eating out or holidays as well as a ‘permissible luxury’ in difficult times.

Communicate more about ethics and sustainability – to help consumers understand why chocolate needs to increase in price and reduce its footprint on the planet. If, collectively, the chocolate industry can increase understanding about these issues, chocolate starts to sit alongside other goods, like a sustainable cotton t-shirt, where we consumers just start to accept chocolate that should cost more.

Could I be More Productive and Reduce the Labour Cost Element of my Products?

If you are using table-top melters or wheel machines, it is highly likely that you would benefit from an investment in a small automatic tempering machine. The cost of this on lease can be as low as £7 per day but the saving in time and the improvement in quality can justify this cost many times over. An automatic temperer is also likely to increase your capacity, which would help you make more chocolates and further reduce your overhead per chocolate.

Please do read our recent article on how to Boost your Productivity with Time-Saving Chocolate Making Machinery for more thoughts and ideas on this subject.

Could I save Money on Ingredients without Sacrificing Quality?

A good way to do this is to switch to ready-made fillings for your pralines, such as Callebaut’s Crème a la Carte, Tintoretto, Crème dell Artigiano and Cremas. Many of these products are cheaper per kg than chocolate but even where they are not, there can be a considerable time saving compared to making a ganache for instance because they are ready-to-use.

In some instances, you may be able to get away with a less expensive chocolate or even a good quality coating, to make your ganache for instance, much like Lindor from Lindt. This however may be a risky and contentious path to go down as you don’t want to risk damaging your hard-earned reputation.

A better solution, especially if you’re making solid bars, to cut costs without “shrinkflation” is to introduce inclusions to replace some of the chocolate content. Most inclusions will be cheaper by weight or volume than chocolate so you have a wide choice. Here are some links to Keylink’s range:

I hope you have found this article helpful, but please do contact us if you have any questions or concerns. You can rest assured that the whole team at Keylink will always be completely focused on supporting you and your business as best we can and that we will always do our best to keep you fully informed.

.svg)

white.svg)